Accounts Payable for Windows

Accounts Payable for Windows is a full-featured accounts payable system designed to meet the needs of financial institutions by automating the invoice processing and payment function.

Accounts Payable for Windows is a full-featured accounts payable system designed to meet the needs of financial institutions by automating the invoice processing and payment function.

If you are looking for a simplified disbursement processing and accounting system to refund credit balances on loans to comply with Regulation Z or to issue refund or rebate payments, look at our Accounts Payable Lite for Windows product.

Key Features

- Employs a Client-Server SQL database that provides the highest level of data integrity, low license fees, and has very low maintenance requirements.

- Capable of multi-company accounting. You can process for multiple organizations.

- Provides predefined and custom check formats and 1099-MISC forms. Use your existing checks: continuous or laser. Multiple payments for a payee can be combined on one check. Facsimile signatures can also be printed on checks.

- Provides California independent contractor reporting.

- Any transaction, posting or check can be reversed with automatic generation of reversing transactions.

- Critical data is fully edited and validated. Data entry is assisted by pick-lists of valid entries from which an entry can be found and selected. New vendors can be added to on the fly as payable items are processed.

- An unlimited number of general ledger distributions can be entered for each payable item.

- Standard distributions provide for quick entry of complex and repetitive distributions with automatic calculation based upon percentages or equal splits.

- Handles both cash and accrual based accounting. You can regularly make payments on a cash basis and perform periodic accrual posting for pending payments.

- General Ledger transactions can be exported to your core accounting system. G/L export formats include:

- Phoenix International

- M & I DataServices

- ITI

- Dimension

- Broadway & Seymour

- Mellon

- BMA BankRite

- Customized and others

- Maintains complete account distribution and payment history for as long as you wish. New payments are checked against previous payments for duplication.

- Full payee/vendor information including refunds and year-to-date purchases. Required reporting for 1099s, requests for missing tax identification numbers and backup withholding is easy.

- Transactions can be batch posted or paid instantly. A “Fast Check” feature will post an individual payment and print a check in less than 30 seconds.

- Includes a complete check/disbursement register and reconciliation system. Check register data can be exported to other systems. Paid items and checks issued are cross-referenced.

- Over 25 standard reports, many with sort and select options. All reports can be previewed before printing. Although a full range of reports can be produced from menu choices, additional ad hoc reports can be produced using a powerful built-in report generator. (Click this link to download printable sample reports in Acrobat® Reader format.)

- An archive add-in module is available. Closed loans and their activity can be transferred to an archive database. Users can easily switch to/from the archive database.

- Provides complete user flexibility, control and ease of use. The program employs modern programming techniques and a proven user interface; most actions can be accomplished in a “point and shoot” manner. What used to take hours can now be done in minutes.

Key Benefits

- Reduce processing time and costs while providing full management, accounting and auditing information.

- Reduce risks and errors because critical data is validated and balanced. Reduce management review time using a pre-post report showing complete payment and distribution information.

- G/L distributions can be entered using predefined standard distributions.

- Provides both cash and accrual based accounting. Your G/L can always reflect your expense/liability situation.

- Avoid duplicate payments. The system automatically checks and flags any possibility of making a payment twice.

- Complete payment history can be recalled instantly or reported at will. Payments and checks are cross-referenced. You’ll be able to reduce departmental file storage requirements.

- Your data is in your computer. No more waiting for reports or delayed posting. Retrieve payment information in less time than it takes to walk to the file cabinet.

- Print checks on your existing forms. Export G/L transactions to your core accounting system.

- Produce year-end IRS information returns (1099s) and requests for tax identification numbers.

- Automatically schedule recurring payments, expense accruals, and short-term asset amortization.

- Compliant with all current versions of Microsoft Windows. Thin-client capable using Citrix or Windows Terminal Services.

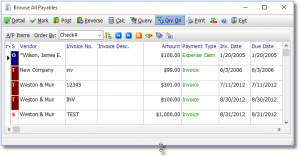

Sample Screens

Pricing

Prices start as low as $2400 for a single user license. Call for specific pricing.

Demonstrations and Evaluation

Online demonstrations of this product are available. Just call us and we’ll respond.

Information

To produce a quick reference, use your browser to print this page.